Southwest Airlines is considering adding a premium class, airport lounges, and even long-haul international flights to compete in a crowded market for high-spending customers.

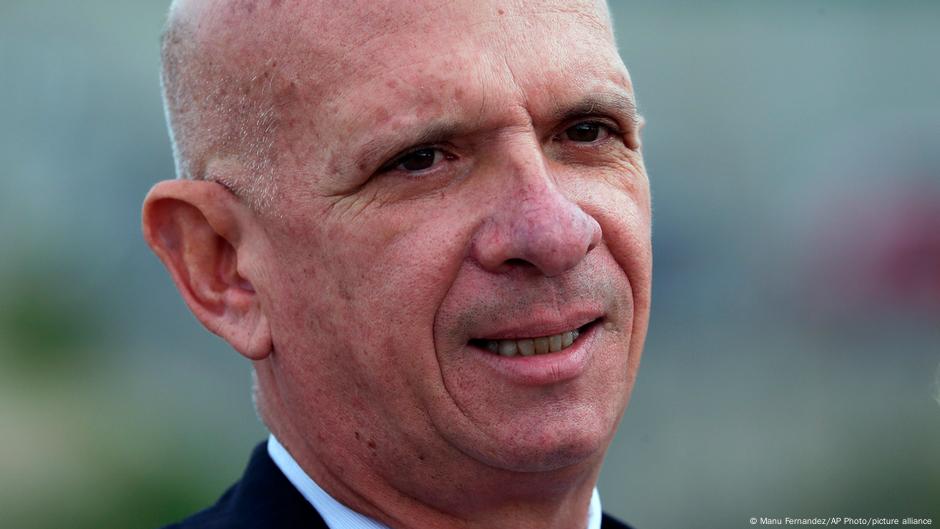

Speaking to CNBC at an industry conference on Wednesday, CEO Bob Jordan said nothing was off the table.

“Whatever customers need in 2025, 2030, we won’t take any of that off the table. We’ll do it the Southwest way, but we’re not going to say ‘We would never do that,’” Jordan said.

“We know we send customers to other airlines because there’s some things you might want that you can’t get on us. That includes things like lounges, like true premium, like flying long-haul international.”

Southwest, founded in 1967 and headquartered in Dallas, is the fourth-largest airline in North America by passengers carried. It now finds itself in the midst of a transformation.

In addition to an increasingly competitive market, this reinvention was partly sparked by a disastrous holiday meltdown in December 2022, which resulted in severe delays and thousands of cancellations. The U.S. Department of Transportation fined the airline a record $140 million.

Southwest’s business model, characterized by high productivity from both aircraft and employees, along with quick turnaround times, has influenced other carriers worldwide, including WestJet in Canada, as well as Ryanair and EasyJet in Europe.

However, in a changing marketplace, it faces increased pressure from competitors, with an activist investor — Elliott Investment Management — pushing the airline to increase revenue, just as fares in the U.S. are falling, amid economic uncertainty.

Long-standing policies that distinguished it from many competitors have been dropped: open seating, a uniform cabin experience, and allowing all customers to check two bags for free. Just last month, major changes were introduced that have long been offered by competitor airlines, including no-frills basic economy tickets and baggage fees. Assigned seating will start in early 2026.

Jordan said these changes have not led to customer defections to rivals, and there is more to come, with the next focus being to make changes for higher-end travel.

The three largest airlines in the U.S. — Delta Air Lines, United Airlines, and American Airlines — have been adding more luxury tourism destinations, roomier (and therefore more expensive) seats, and have heavily invested in upgrading their airport lounges, which are seen by many customers as an important part of the travel experience.

American unveiled plans to almost double its lounge space at its Latin America hub at Miami International Airport.

While Jordan admits it is “way too soon to put any specifics” on potential changes, he did drop some big hints.

One of Southwest’s strongest markets is at Nashville International Airport, where it holds a market share of more than 50 percent.

“Nashville loves us, and we know we have Nashville customers that want lounges. They want first class. They want to get to Europe, and they’re going to Europe,” Jordan said.

Currently, if Southwest passengers want those things, they have to book on another airline, and that also makes them more likely to take out a competitor’s co-branded credit card, he noted.

“I want to send fewer and fewer customers to another airline,” he said.

It’s too early to say whether Southwest will make the shift to buying longer-haul aircraft, which it would need to serve destinations like Europe, Jordan said — the airline has relied on the Boeing 737 for more than half a century.

As a stepping stone to that goal, Southwest has been forging international partnerships, so far with Icelandair and China Airlines.

However, Jordan said that a Southwest plane landing in Europe at some point is on the table.

“No commitment, but you can certainly see a day when we are as Southwest Airlines serving long-haul destinations like Europe,” he said.

“Obviously, you would need a different aircraft to serve that mission, and we’re open to looking at what it would take to serve that mission.”

4 hours ago

1

4 hours ago

1

.JPG)